In the beginning, there were institutions...thoughts on institutions, economics and other random topics.

Saturday, August 1, 2009

Political Compass

Economic Left/Right: 1.00

Friday, July 31, 2009

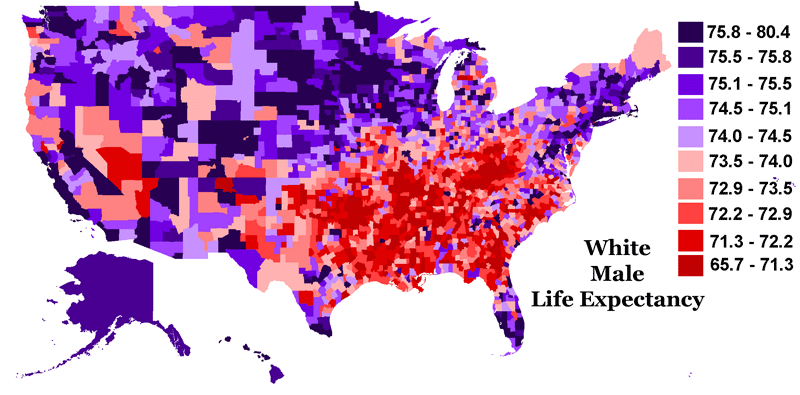

Life Expectancy Arguments

At birth, someone living in the Netherlands can expect to live 2.35 years longer than someone born in the US, but at age 65, the difference is reversed, and someone living in the US can expect to live 0.4 years longer than someone living in the Netherlands. This difference can be explained by assuming that semi-socialized health care is better for young and worse for old people, or, at least as likely, different policies are not the main cause of the difference

Sources: CDC national vital statistics 2004, www.cdc.gov/nchs/data/nvsr/nvsr56/nvsr56_09.pdf and RIVM 2007 levensverwachting, www.rivm.nl/vtv/object_document/o2309n18838.html (in Dutch)

So, the question still remains on distribution. Is it better to increase the likelihood that citizens are able to reach the age of 65 or that those who do (either because they are congenitally wealthier or healthier) live even longer? There are a lot of interesting tradeoffs in the debate, and the politicians are not focusing on any of them because the old conflicts over class and culture play better to less affluent voters (remember more than half of all Americans have below-average incomes).

Credibility problem

Thursday, July 30, 2009

Today's reason neither politicians nor doctors want to lower costs

From a very good piece in the NYTimes on lobbying:

Hint: McAllen Texas has the highest health care costs in the country.One of the largest sources of campaign contributions to Senate Democrats during this year’s health care debate is a physician-owned hospital in one of the country’s poorest regions that has sought to soften measures that could choke its rapid growth.

According to the Times, the hospital has been quite successful in its efforts. And where is this powerful hospital with all the lobbying money located? Why in the metropolitan area of McAllen, Texas. McAllen, Texas? Hmmm...now where I have heard that name before?

Hmmm.

It's worth pointing out that PowerPoint presentations are generally better than many older classroom technologies, like slate chalkboards or overhead transparencies filled with hand-scrawled notes that students struggled to decipher. So computers have probably led to a slight improvement in teaching.So, as usual, it's not really so much the technology as much as it is how you use it. Technically, I use "smart boards" and "Power Point" but I almost never use pre-made slides anymore. I use the laser pen and palatte to draw and write the main points while I mention them. Over the last couple of semesters, students who complained about "boring power point" lectures were usually ones who had other issues with the difficulty of statistics generally or their grade specifically.

Also, I've been reading some studies on so-called "active learning." Much of it finds that active learning does not improve mastery of concepts. However, it does improve student perceptions (and teaching evaluations), and thus I have been investigating various gimmicks to introduce more "active learning" in my classes.

Wednesday, July 29, 2009

Small businesses also pay more for health insurance than large companies. According to the Commonwealth Fund, small businesses now pay 18 percent more than large businesses pay to obtain comparable insurance.Adverse selection?

Kenneth Arrow

Part one: Economics and business cycles

Part two: Health Care

I guess this is one of my favorite quotations from it:

One point was that health is a random event. It's not like buying automobiles. Whether you're sick or not is hard to predict. Some get sick and some don't. That uncertainty makes it an ideal scenario for insurance. Some houses burn and some don't, but you know whose. So you have fire insurance. (And by the way, financial problems have the same characteristics, and I was always interested in the subject -- the uncertainty.)Later,

But in the case of health care there are three players: the insurance company with the health plan, the physician, and the patient. The physician presumably has a better knowledge of what the patient needs -- at least better than the insurance company does. So the insurance company could never put together a bill. There is also a Physician and patient relationship, but the physician knows more than the patient.In other words, even if a 2 quart bottle of ketchup costing twice the price of a 1 quart bottle shows market efficiency for ketchup, insurance (and financial) markets work much differently. Of course, I've made these points about adverse selection and moral hazard casually myself, too, but getting them from a Nobel (who isn't Krugman) probably adds more weight.

There are information asymmetries in this story. Health insurance is limping along. It's limited in scope, and then you other consequences. Insurance companies have high premiums to protect themselves. The ones who come to the insurance company are sicker and the people have to pay more. You have adverse selection. You have moral hazard. And the doctor does what's on the safe side -- defensive medicine -- without regard to cost. These are fundamental conditions that make health insurance difficult.

On the policy side, Arrow had a nice result in his 1951 Ph.D. thesis known as the impossibility theorem.

Life Expectancy Math by Bill O'Reilly

I thought yesterday was funny. Bill-O shows his complete lack of statistical literacy in this clip.

Tuesday, July 28, 2009

Rational Explanation for Hating Meetings

I find one meeting can sometimes affect a whole day. A meeting commonly blows at least half a day, by breaking up a morning or afternoon. But in addition there's sometimes a cascading effect. If I know the afternoon is going to be broken up, I'm slightly less likely to start something ambitious in the morning. I know this may sound oversensitive, but if you're a maker, think of your own case. Don't your spirits rise at the thought of having an entire day free to work, with no appointments at all? Well, that means your spirits are correspondingly depressed when you don't. And ambitious projects are by definition close to the limits of your capacity. A small decrease in morale is enough to kill them off.

Each type of schedule works fine by itself. Problems arise when they meet. Since most powerful people operate on the manager's schedule, they're in a position to make everyone resonate at their frequency if they want to. But the smarter ones restrain themselves, if they know that some of the people working for them need long chunks of time to work in.

Emphasis added by me (for no particular reason).

Health Care Quality is Better in the US

What People Don't Know Could Fill the Oceans

At a recent town-hall meeting in suburban Simpsonville [SC], a man stood up and told Rep. Robert Inglis (R-S.C.) to "keep your government hands off my Medicare.""I had to politely explain that, 'Actually, sir, your health care is being provided by the government,'" Inglis recalled. "But he wasn't having any of it."

Friday, July 24, 2009

On Being Tall...

I suspect Greg Mankiw is not overwhelmingly tall. But, by Mr. Mankiws rationale is correct, why not tax being white, or male (after all, they tend to make more, on average, too)? I don't think Mankiw would support that. It might be because, even though it doesn't tax effort, discriminatory taxes that are based on the genes someone is born with would erode government credibility.

On a observartional note, I'm guessing if it were turned over to politicians, democrats would turn it into a short-person subsidy, and the republicans would make it a "tax credit" (which of course would be self-defeating as a redistributional matter since it would subsidize the short people who get paid highly the most). After all "tax" is a four letter word to politicians.

Of course, we all know what would happen here... Since, as conservative politicians point out, the whole financial-housing mess was caused by a law thirty years ago encouraging a small portion of loans to go to low-income homebuyers (somehow taking thirty years to work itself out), we can see the moral hazard here. Parents will deliberately malnourish their children to game the system and increase their chance of being eligible for the subsidy (or avoid paying the tax). Stop taking those prenatal vitamins, honey!

Wednesday, July 22, 2009

Insurance Generosity Curves

So, basically, 48 million Americans are on the horizontal segment; they don't pay for insurance, and they do not receive any benefits. Then if they pay some threshold per year (say, 2,000 for themselves and 5,500 paid by their employer as a "non-wage benefit") they get minimal coverage that increases in generosity as more is paid in.

So, basically, 48 million Americans are on the horizontal segment; they don't pay for insurance, and they do not receive any benefits. Then if they pay some threshold per year (say, 2,000 for themselves and 5,500 paid by their employer as a "non-wage benefit") they get minimal coverage that increases in generosity as more is paid in.So, what might happen if the "public option" were introduced? What if it was lower quality as critics suggest? It might look something like this:

Thus, there would still be a discontinuity in the relationship, but at the bottom could be lifted without necessarily changing the rest. But, you might say, what about people who get seduced by the cheaper option? Here I ask, "what's the big deal?" The fact that they choose it when there are more generous (and more expensive options) proves that they are better off, on average, by revealed preference, and they have money to save up in case they want to pay in for a big procedure that the big mean bureaucrats won't pay for. The curve might look something like this:

If there are no distortions, then maybe the Feds insure 70 million or so, instead of the 48 million that were uninsured (but they also insure another 45-50 million from other existing public programs for a total of about 120 million people) If there are distortions, it might shift the curved segment like this:

If there are no distortions, then maybe the Feds insure 70 million or so, instead of the 48 million that were uninsured (but they also insure another 45-50 million from other existing public programs for a total of about 120 million people) If there are distortions, it might shift the curved segment like this:

Here, the benefits for people paying might decline, but the question is how much, it is unlikely that rich folks won't still have a "Cadillac option" that is as generous as they want it to be. (Another question is who are these people receiving the lowest benefits "on the new curve?" Are they people who had private insurance before, or are they on medicare/aid or other publicly-funded benefits? Are they people who were already at that level on the curve but decide to pay for the private option in spite of an available public option, i.e. to what extent are the "payers" moving horizontally, receiving the same benefits, versus down, receiving less, but still paying?)

One thing that this doesn't suggest, is that assuming inferior care by the government private insurance would go out of business. For that to happen, it's almost as if you would have to admit that the government plan is at least as good as a marjority of the points "on the curve." If they offer higher quality they should be able to keep charging a profitable price and compete on quality. If you think the government would compete the private insurers out of the market entirely, it's hard to make the case that their quality wouldn't be somewhat comparable.

An interesting note on the "fairness" of the Tax System

House or senate

Budget Hawks?

| Count of Vote | Party | |||

| Vote | D | I | R | Grand Total |

| Yea | 42 | 1 | 15 | 58 |

| Nay | 14 | 1 | 25 | 40 |

| Not Voting | 2 | 2 | ||

| Grand Total | 58 | 2 | 40 | 100 |

| Chi-Squared Test for Independence: | 15.207 | |||

From a Chi-Squared distribution with 4 [(r-1)*(c-1) with r = # of rows, c = # of columns) degrees of freedom, the 1% critical value is 13. 277, so since 15.2 is greater than 13.277, we can conclude in this case that there were differences. However, there may be lurking variables here, such as how much money gets sent to a district for the program. Maybe Republican states just get more financial benefit from defense-industry spending.

UPDATE:

To control for this a bit, I looked at states where the party differed. Here's the new crosstab:

| Count of Vote | Party | ||

| Vote | D | R | Grand Total |

| Nay | 2 | 7 | 9 |

| Yea | 10 | 5 | 15 |

| Grand Total | 12 | 12 | 24 |

| Chi-Squared Test for Independence: | 4.44 | ||

Here, we have a Chi-Squared distribution with one degree of freedom (there weren't any abstainers and I counted Joe Lieberman as a Democrat instead of "independent democrat"). The critical value for a 5% level of significance (still pretty good) is 3.841, so since 4.44 is greater than that, we can say that even controlling for state, there were significantly more Republicans who voted to keep the 2 billion dollar fighter in the budget.